Can an Employer Contribute to an Employee's HSA? Yes and they should

There’s no stopping the growth of health savings accounts (HSAs).

According to the latest release of the Devenir HSA Report, HSAs are the fastest growing consumer-directed healthcare account in America today. As of the end of 2018, the total number of HSAs have exceeded 25 million (up 13 percent year over year) and hit $53.8 billion in total assets.

More importantly, HSAs achieved an annual growth in assets of 20 percent, a sign that their growth isn’t slowing down any time soon.

The rising popularity of HSAs would suggest more employees are realizing the unique value the healthcare accounts can provide for both medical savings and retirement savings.

The reality is, however, that a sizable number of employees are still not taking advantage. Nearly half (43 percent) of all employees enrolled in an HSA did not contribute any of their own money to their accounts.

While it’s unfortunate that so many employees are missing out on the enormous savings opportunities that accompany an HSA, employers are well-positioned to optimize their employees’ use of the tax-deductible accounts through HSA employer contributions.

Here are three reasons why employers should contribute to employees’ HSAs.

Helps employees overcome their financial fears

HSAs directly impact an employee’s ability to save for their present or future medical costs. And with 82 percent of employees seeing medical costs as their biggest challenge both now and in the future, HSAs stand to be very beneficial.

Despite having access to a savings vehicle, employees still struggle with believing they have enough money to make HSA contributions in the first place. In a survey, roughly one in four employees who didn’t enroll in an HSA said they didn’t have enough money to contribute.

To add to the problem, employees’ top fear about enrolling in an HSA program is high claims and low HSA balances early in the year. For employers, this presents a fantastic opportunity to positively impact not only their employees’ financial state, but their perception or attitude toward HSAs.

Employers are able to offer lump-sum contributions at the beginning of each year or contribute seed money as employees enroll in an HSA for the first time. Nearly two-thirds of employers that offer HSAs are already contributing seed money. In 2017, median seed amounts ranged from $300 to $750 for employee-only coverage and $700 to $1,400 for family coverage.

An employer-funded HSA gives employees a financial boost to avoid the common fear of high claims and low HSA balances, helps squash concerns of inadequate HSA funds and enables more employees to see first-hand the incredible value of an HSA.

Empowers employees to stay engaged financially

Similar to how seed contributions can jump-start an employees’ willingness to enroll in an HSA, monthly employer contributions help employees stay more engaged financially in their HSAs.

There are a couple of options: An employer can contribute a flat amount each month or match employee contributions each pay period.

Either way, an employer can contribute funds to invest in their employee’s health savings—and even retirement—which will only stand to encourage employees to remain diligent in their own involvement with HSAs. The longer employees stay engaged in their HSAs, the greater chance the benefits of an HSA will make a lasting impact.

Enables better health outcomes for employees

In 2017, one-in-four American families refused necessary medical care because they did not have the money to pay for it. Refusing medical care will not lead to more positive health outcomes.

Fortunately, HSAs exist to simplify healthcare-related savings for account holders. Employer-funded HSAs will help employees stay more engaged in their HSA, and better position them to have the funds set aside for necessary medical care.

As a result, employees can get the care they need which will help improve their overall health outcomes.

When employers fund employees’ HSAs, more employees realize the advantages of their account. In addition to the tax-deductible nature of the employer contributions, employers stand to benefit tremendously from funding employee HSAs because it empowers healthier employees—both financially and physically. As HSAs continue to grow, so should the number of employers contributing to HSAs for the well-being of their employees.

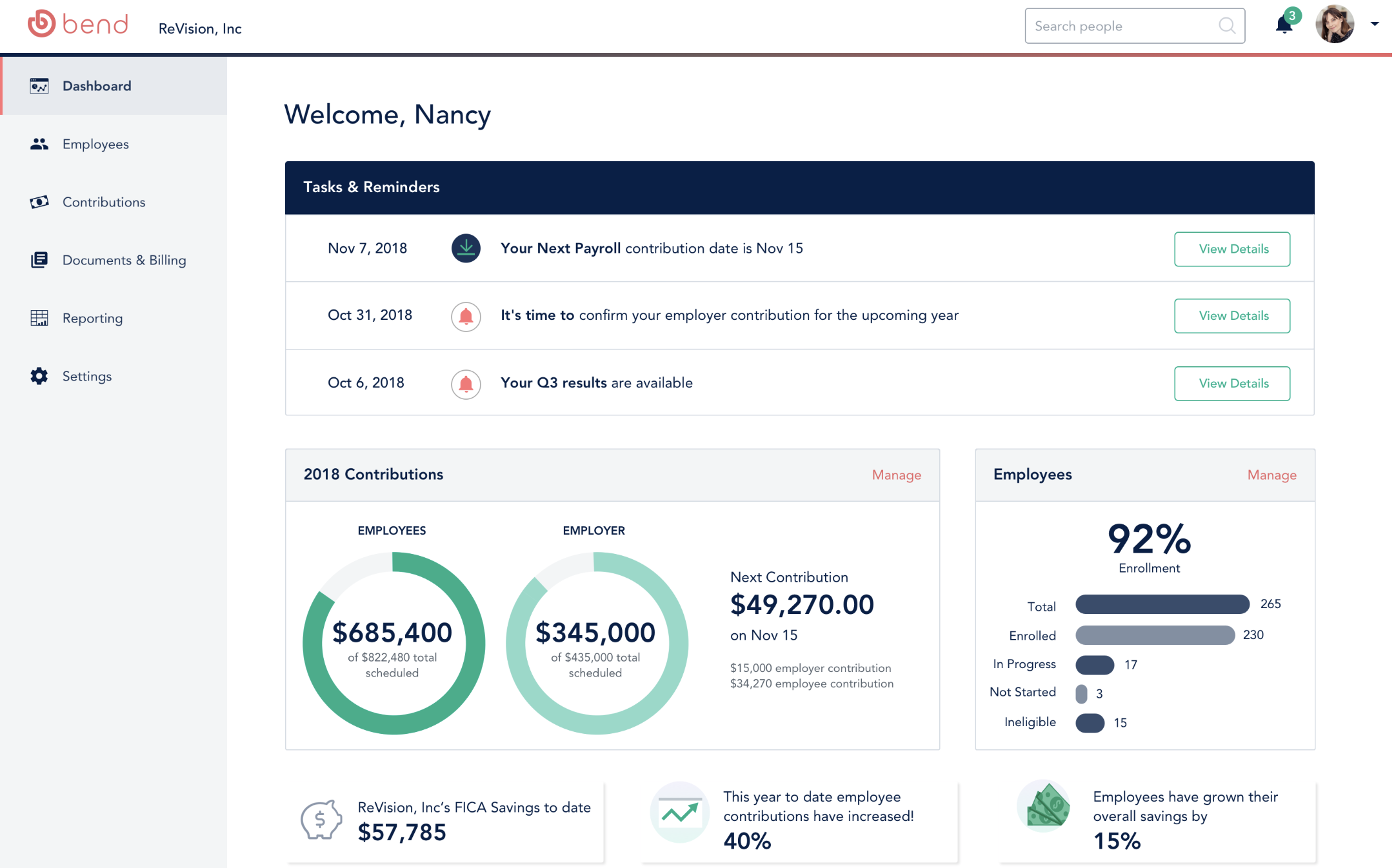

Learn more about how Bend can help your employees get on the path to financial health.

You May Also Like

These Stories on Employee Benefits

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

.jpg)

No Comments Yet

Let us know what you think