Achieve better financial wellness

Ditch the guesswork with the best HSA

Leave the guesswork and headaches behind. With a Bend HSA, you can maximize every aspect of your health savings account from day one, even without any HSA knowledge. We make HSAs easy for everyone.

Open Your HSAWhy choose a Bend HSA?

We’re all about HSAs. Bend is the only HSA partner committed to simplifying healthcare saving through personalized guidance designed to help you make the most of your account through every step of your HSA journey. Save on taxes. Take better control of your healthcare expenses. Invest in your future. Boost your bottom line. If you have an HSA-eligible HDHP, you need a Bend HSA.

More HSA ResourcesSave today and for tomorrow with the smartest HSA and best HSA investment experience

With a Bend HSA, you get the smartest, most advanced HSA on the market—no gimmicks, hidden costs or strings attached. Plus, your Bend HSA gets you seamless access to a fully integrated HSA investment experience offering a suite of best-in-class features, including fractional trading, multiple investment models, exchange-traded funds (ETFs) and much more.

Have your investment managed for you. Choose from a carefully cultivated list. Or go all-out DIY with an open brokerage investment account. With a Bend HSA, the choice is yours.

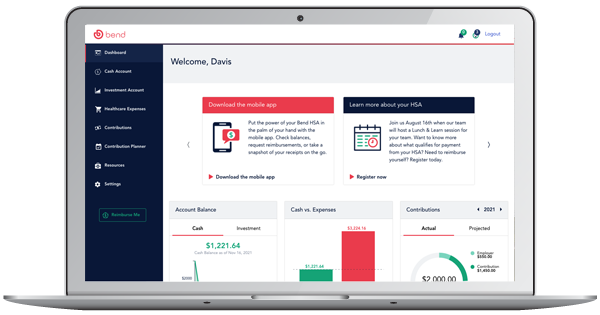

The features you need to make managing your HSA quick and easy

Bend HSA has been thoughtfully designed to make your life easy. Stop stressing over managing and tracking your healthcare expenses. With a Bend HSA, you get simple, one-click access to:

- Fund your account and control HSA contributions

- Track your health plan deductible and healthcare expenses

- Get reimbursed for HSA eligible expenses

- Monitor tax savings

- Find resources on HSA benefits

- Invest your HSA funds

- And more

Let Bend do the work.

The Bend Advisor

Your Bend HSA comes equipped with the Bend Advisor—a unique tool that helps you every step of the way through real-time, personalized guidance and support. The Bend Advisor does the work for you, pulling in data from your other accounts—like checking, credit cards, payroll and health plans—and takes the guesswork out of managing your account and maximizing your HSA benefits.

With the Bend Advisor, no expenses are left behind and you don’t need to worry about remembering what you paid for, with what account and if those expenses were eligible or not. You maximize your HSA and learn as you go—and before you know it, you’ll be an HSA pro.

The Bend DifferenceEverything you need to make the most of your HSA

From contributions and payments, to comprehensive account dashboards and easy investment options, your Bend HSA provides you on-the-fly access and all the tools you need to make the most of your HSA from day one—without any hassle, headaches or runaround.

- Contributions—Easily fund your HSA online with recurring or one-time contributions, link your bank accounts with the click of a button, explore options with our Contribution Planner tool and more.

- Payments—Use your Bend HSA debit card or any number of personal payment options for HSA-eligible expenses—at the doctor, dentist, pharmacy, optometrist and more.

- Eligible expenses—Link your accounts to your Bend HSA and let the Bend Advisor track your eligible expenses for you. Add receipts to your online shoebox for easy recordkeeping. Get reimbursed immediately or save expenses for future reimbursement. With a Bend HSA, you never miss out on an eligible expense.

- Account dashboards—The Bend Advisor watches over your contributions, categorizes your expenses and makes sure you get maximum tax benefits. And you have on-demand access at all times through one user-friendly dashboard.

- Investments—Seamlessly invest your HSA funds whenever and however you choose with a variety of best-in-class options and offerings.

Don’t wait another day to start achieving HSA success.

Open your HSA today© Bend Financial Inc., 2024 | Privacy

Contact Us

Contact Us