When it comes to health insurance, the insured employee requires a lot of educational effort on the part of the employer. One of the main challenges of top-notch employee benefit packages is continuing education, after open enrollment, to ensure the greatest ROI for the insured.

Despite the significant intellectual capital spent by the employer through the design and communication of an effective benefits package, employees still struggle to understand the complex terminology, features and benefits of their coverage.

A high-deductible health plan (HDHP) can add to this complexity. An HDHP is usually accompanied by a health savings account (HSA), which allows employees to save for health-related expenses. The rise in popularity of HDHPs has led to a massive 400 percent increase in HSA-HDHP enrollment over the past decade. Yet despite increased enrollment, most consumers still have misconceptions about HSAs. For example, a 2017 study still found that three in 10 Americans did not know that HSAs were not governed by a “use it or lose it” policy—a basic distinction between an HSA and a flexible spending account (FSA).

Where's the disconnect?

Too many employees only look at healthcare as a short-term obligation over the next 12 months. In reality, however, an individual’s healthcare is a lifelong undertaking. The vast majority of Americans will use most of their healthcare dollars after retirement. A recent Mercer study discovered that on average an American couple will incur $275,000 in long-term services and support costs during retirement.

Instead of this big-picture view, we struggle to think past the next 12 months of insurance premiums, deductibles and copays. By not adjusting their perspective to a long-term focus, many employees will find themselves unprepared for this kind financial burden later on in life.

HSAs provide long-term preparation

In conjunction with a high deductible health plan (HDHP), HSAs are the only healthcare vehicles that allow an employee the opportunity to accumulate equity in their own healthcare future Among the various benefits HSAs can offer are the ability to roll over contributions each year as well as accumulate a “bank” of eligible expenses that can be used for tax-free withdrawals in the future; whereas, the typical PPO plan only covers the current year’s expenses with no way to offset out-of-pocket costs incurred in the future.

Similar to how a 401k enables employees to look into the future of their retirement, HSAs provide the same long-term perspective for employees’ healthcare. Only HSAs give employees the chance to prepare for the expected rise in health costs during the latter part of their lives and approach healthcare as a long-term investment rather than a short-term obligation.

The uniqueness of HSAs in their impact to employees and their future health-related costs only underscores the importance of employers including them in their health benefits package offerings for the financial wellness of their employees.

Creating a powerhouse HSA

Of course, it’s not enough to simply offer HSAs to employees. HSAs are most effective when they are proactively engaging employees. Unfortunately, most HSA options are reactive and simply wait for an individual to put money in the account. In fact, 24 percent of current HSAs opened by employees sit inactive.

Proactive HSAs engage employees, ranging from non-funders to active HSAs participants, and help keep accounts from lying dormant. When there’s a consistent effort from an HSA to educate and assist employees on how to maximize savings, they are better positioned to reap the benefits of saving for their health-related costs long term.

The three characteristics of a powerful HSA offering provide employees with the financial savings security blanket and short-term tax savings while also helping make healthcare costs more affordable.

Leverages technology - Most HSAs are simply an online deposit account designed for debit transactions. However, an HSA with robust technological capabilities, such as artificial intelligence, is able to understand and anticipate an employee’s unique spending habits and situations and then make actionable recommendations to educate them on how to maximize their HSA funds. Artificial intelligence can satisfy the need for ongoing education for the majority of employees that don’t understand how to maximize their tax savings through the HSA.

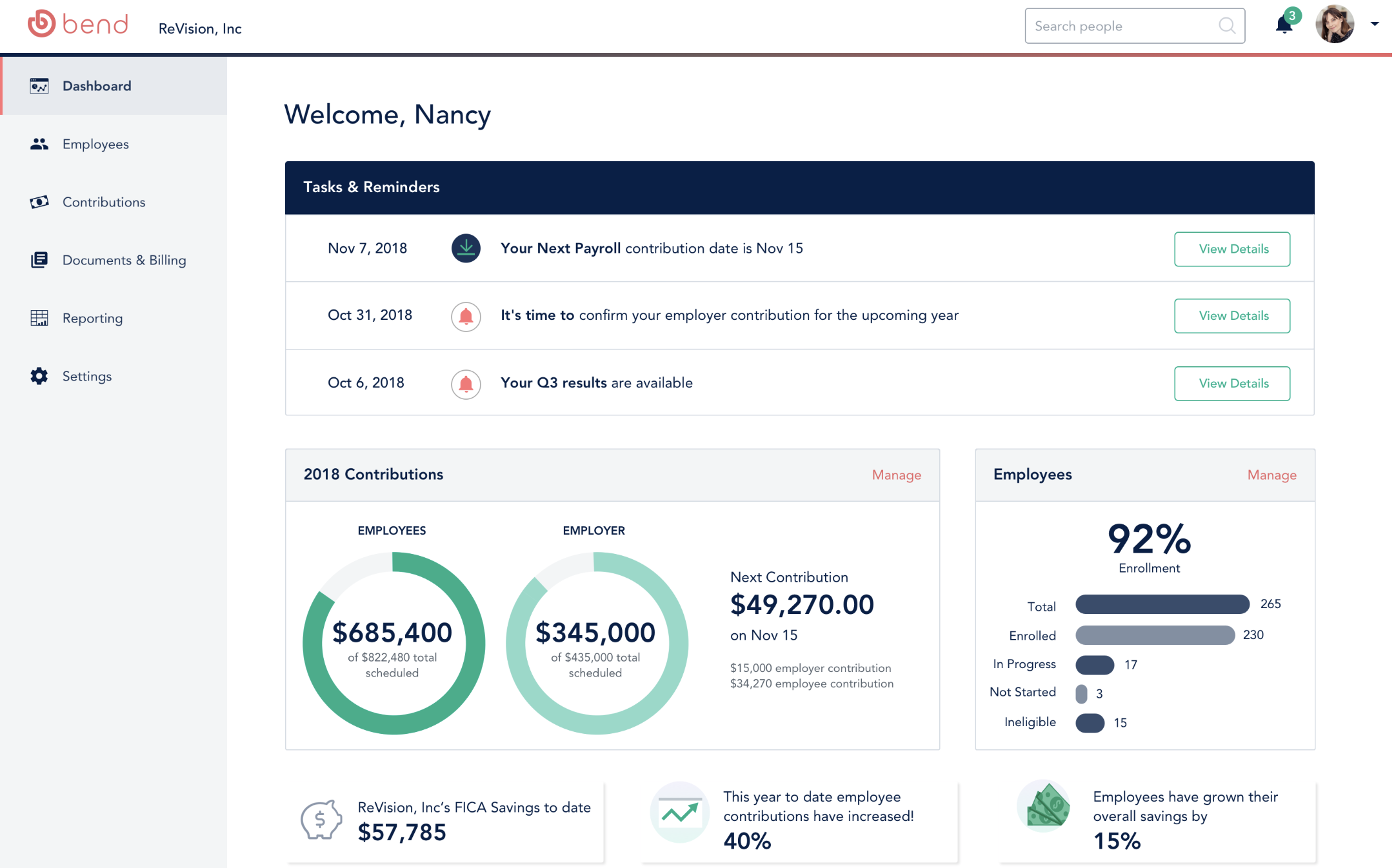

Simplifies administration and HSA enrollment - Too often, employers don’t receive adequate support from HSA providers in administering the accounts to their employees. An HSA provider that automates payroll management, and simplifies both the administration and implementation of the accounts, as well as the enrollment of employees, will make for a more satisfying experience and preparation for the inevitable increases in out-of-pocket healthcare costs as retirement approaches.

Doesn’t let account holders get complacent - The reactive nature of HSAs only hurts employees in the long run by allowing them to get complacent in how they either contribute to their HSA or let it sit inactive. Proactive HSAs that actively engage account holders with timely nudges, such as reminders to contribute, as well as document eligible expenses for future reimbursement, will help ensure each account holder is on a journey to optimizing their contributions and maximizing their savings. Currently available technology not only enhances savings opportunities, but also maximizes the capturing of eligible expenses and will ensure the accountholder takes full advantage of the triple tax savings that only an HSA can provide! This same technology also automates payroll management and administration of HSA related tasks.

Playing the long game

The temptation for many employees is to simply view healthcare and health insurance only in the short term. This kind of perspective can be deceiving, however, given the natural inflation of healthcare costs, the rising need for healthcare as we age and the typical financial burden of six-figure healthcare costs in retirement. The unique ability of HSAs to lessen this burden positions them to be a valuable resource for employees who choose to enroll in an HDHP. As an employer, offering a proactive HSA platform that overcomes the traditional barriers of HSA participation empowers more employees to make smarter, advantageous decisions regarding their health-related financial savings.

If you would like to step up to a better HSA, reach out to sales@bendhsa.com.

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think