How Your Health Savings Account Can Be a Great Retirement Vehicle

In reality, however, an individual’s healthcare is a lifelong undertaking. The vast majority of Americans will use most of their healthcare dollars after retirement. A recent Mercer study discovered that on average an American couple will incur $275,000 in long-term services and support costs during retirement.

With this kind of financial burden in the futures of many, it’s even more imperative that proper financial planning take place ahead of time so that individuals are best positioned to overcome the challenges and expenses of long-term services and support costs.

This is also what makes health savings accounts (HSAs) so valuable.

In addition to using the HSA as a savings account for qualified medical expenses, an employee can use an HSA as a retirement account with advantages distinct from 401(k) plans.

Why have an HSA retirement account? True tax savings!

Easily one of the most unique and popular benefits about having an HSA as a retirement account is for the tax savings.

HSAs are triple tax-free.

HSA payroll contributions are made pre-tax. When balances are used to pay qualified healthcare expenses, all withdrawals come out of an HSA tax-free. Plus, interest and earnings on HSA balances also accumulate tax-free.

Unlike pre-tax 401(k) contributions, HSA contributions made from payroll deductions are truly pre-tax because Medicare and Social Security taxes are not withheld.

HSAs withdrawal rules

With an HSA, withdrawals can be made at any age for qualified medical expenses—such as co-pays, deductibles and medical care—and the money is never taxed. However, if the money is used for anything other than a qualified medical expense, the withdrawal is subject to a 20 percent penalty tax in addition to regular income tax that must be paid on the withdrawn amount.

In comparison, any 401(k) withdrawal made before age 59 ½ is subject to a penalty tax, regardless of how the money is used.

After age 65, HSA accountholders can use the funds for any reason without penalty. However, withdrawals for non-medical expenses are subject to income tax.

HSA investment strategy

While HSAs help individuals make better financial decisions when it comes to their medical expenses, the savings account is also a smart investment tool that can improve one’s financial situation during retirement.

The key is to restrict spending the funds in the HSA as much as possible. If necessary, spend the funds only on qualified medical expenses.

By adopting an aggressive plan to consistently contribute to an HSA at or near max level, accountholders who save their funds will see their balances grow exponentially over time thanks to earning interest.

Individuals can invest their HSA funds in diverse portfolios similar to the strategies seen with 401(k)s, but with earnings and interest growing tax-free, it makes HSA funds all the more valuable when compared to 401(k) funds.

Can an HSA be used to pay for health insurance premiums in retirement?

Contributing to an HSA is a great way to prepare for medical expenses in retirement—which includes paying for Medicare.

It’s important to remind employees that Medicare isn’t free. Similar to other types of health insurance, Medicare recipients pay monthly premiums and are responsible for deductibles and co-pays. As with any insurance plan, there are different levels of coverage—and there are some things that Medicare just doesn’t cover, including dental care, prescriptions, eyeglasses and hearing aids.

The good news is that employees can use their HSA to pay for premiums in retirement. The IRS allows Medicare to be treated as eligible medical expenses for individuals who are 65 or older. Those funds can also be used to pay for out-of-pocket costs not covered by Medicare.

HSA and retirement savings

What happens if employees don’t use their HSA money? They grow retirement savings.

Perhaps the most common misconception about an HSA is its rules regarding year-end balances. Unlike the similarly named flexible spending account (FSA), HSAs do not hold a “use it or lose it” policy for its account balances.

Accountholders are able to carry over their HSA balances year to year. Better yet, account balances follow employees even if they change jobs or switch HSA vendors.

The ease of carrying balances year to year not only reduces a lot of the stress that can come with a “use it or lose it” policy, but it also allows the account to grow quicker thanks to interest earned on accounts with larger balances.

The larger the balance, the more it grows and becomes an effective savings vehicle for those significant health costs during retirement.

Catch-up contributions

Employees can use their HSA for retirement planning through catch-up contributions.

The maximum pre-tax contributions for 2019 are $3,500 for individuals and $7,000 for families. However, federal rules permit HSA-eligible employees age 55 and older to contribute an additional $1,000 per year to “catch up” on their savings.

Catch-up contributions help older accountholders save more money in their HSA to keep up with age and increasing medical care needs. Furthermore, the sheer increase in HSA contributions only allows for more benefit later down the road with larger balances to cover both qualified and unqualified medical expenses during retirement.

Despite these retirement benefits, many Americans are still unaware of the value HSAs hold for those in the latter parts of their lives. Only 29 percent plan to use their HSA for help in retirement, whereas, nearly half of Americans still plan to use their 401(k) savings for their medical costs during retirement.

Fortunately, HSAs are growing more popular every year. And it’s no surprise. With tons of tax benefits, savings that span both short-term and long-term medical costs, and robust investment opportunities, HSAs are a great way for employees to ensure they have ample funds on hand to pay for expenses long into retirement.

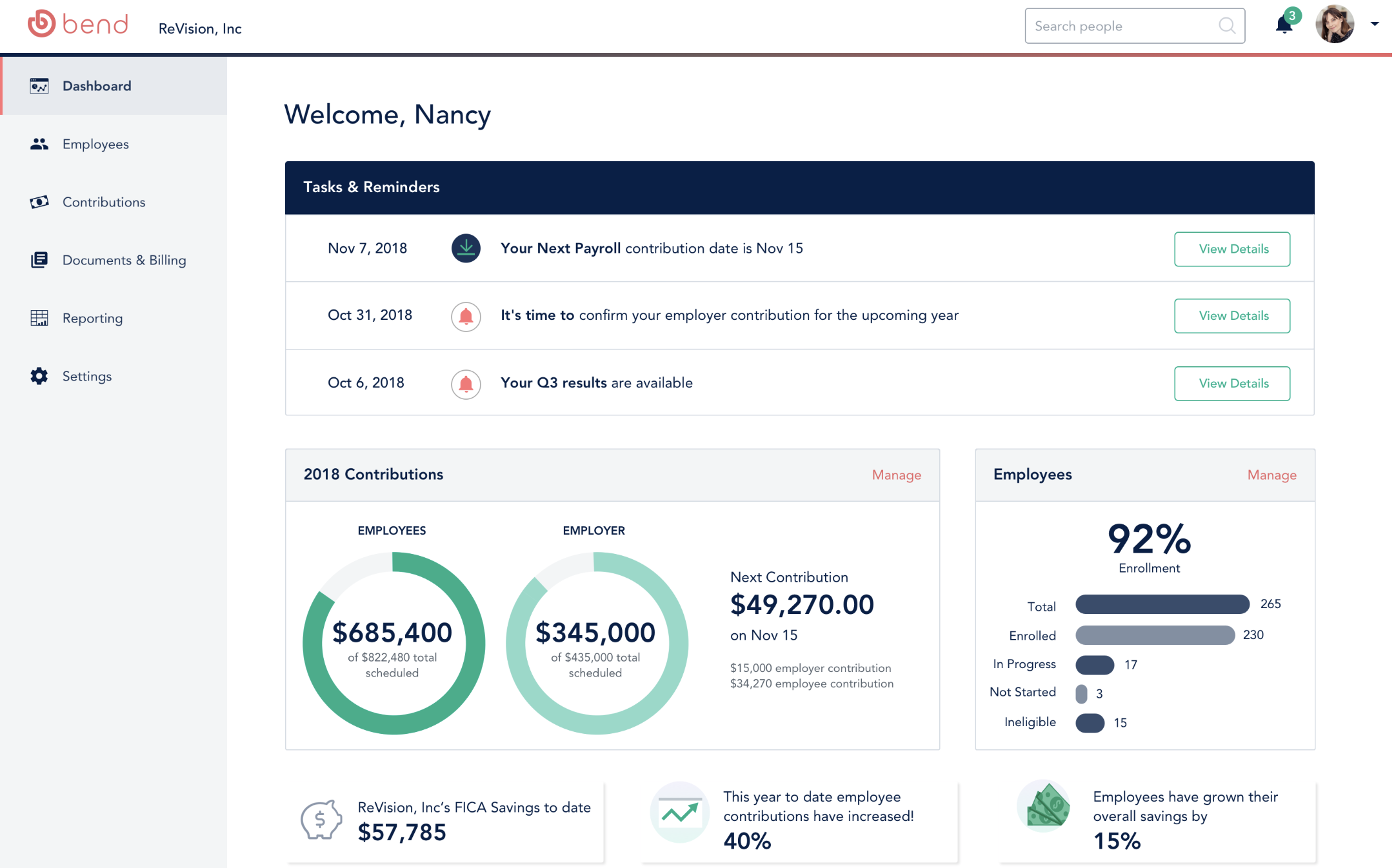

Learn more about how Bend can help your employees get on the path to financial health by using an HSA for retirement.

You May Also Like

These Stories on HSA

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think