Employee Financial Wellness: Ways to show you care

Your employees are stressed about their finances. And it’s not just those with entry level salaries—financial insecurity is pervasive. It crosses generational lines and affects those in every position.

That financial stress is now taking a toll on the health of our workforce, contributing to absenteeism, low performance, poor morale, worsening health and—with that—increased healthcare spending. So, what do employees need to achieve financial wellness? And what can your company do to help facilitate it?

Our new eBook looks at how employers can help ease some of these financial stresses – including by pairing their employee financial wellness program with an HSA-qualified high-deductible health plan.

Benefits that support employee financial wellness

Financial literacy

To combat stress and help employees feel more confident about their finances, employers should promote financial literacy programs throughout the company.

Financial education methods can include voluntary classes or workshops, free personal consultation services, retirement income calculators, and online informational resources. Employers who implement financial literacy programs into their overall employee financial wellness offerings are positioning their employees for greater success both in job performance and money management. Not only do these programs provide better debt and retirement savings outcomes, but they can help increase employee productivity, morale, engagement and loyalty.

Retirement planning

Retirement and retirement planning are almost synonymous with 401(k) plans. It’s become a go-to retirement strategy.

Robust retirement planning offerings from an employer is an easy way to stand out from the competition in attracting top talent. Aside from simply offering a 401(k) plan, instituting a match could be very beneficial as well, considering 49 percent of employers with a 401(k) plan fail to match any amount.

Plus, plans with no employer contributions typically carry average participation rates approximately 10-15 percent lower than those with a match. Employers also see almost a 50 percent increase in the amount of money contributed to retirement by employees when any kind of match was offered.

529 education plans

These are education savings plans that offer tax and financial aid benefits to help pay for college as well as K-12 tuition and are typically set up using mutual funds and can be as easy to invest in as a 401(k) plan. They have the potential to reduce worker stress related to paying for a child’s tuition.

Health savings account (HSA):

There’s arguably no more effective way for an employer to positively impact an employee’s long-term personal financial wellness than by offering a health savings account (HSA). Since 2003, HSAs have been available to those with high-deductible health plans (HDHPs), providing immense tax benefits and reduced costs for employers and employees.

A recent survey found that 40 percent of Americans with employer-sponsored health insurance struggle to pay for their healthcare costs, especially those with chronic conditions. Affordability continues to be an issue for those with employer-sponsored health insurance due to drastic increases in out-of-pocket spending. HSA plans are an extremely practical and effective solution to help more employees afford and save for future healthcare costs.

Why an HSA? HSAs are what financial experts call triple tax advantaged, and there’s simply no more effective way for an employer to impact an employee’s long term personal financial wellness.

HSAs help employees avoid financial hardship from healthcare expenses by saving for them in advance. They’re a tax-free investment that employees can carry with them through retirement, allowing them to pay for medical expenses without penalties or federal taxes.

Which HSA is right for my company? Choosing the right HSA matters. Employers should partner with a financial institution that seeks to understand their goals for the HSA program and will help them form a plan that points their employees toward lasting, positive behavior change.

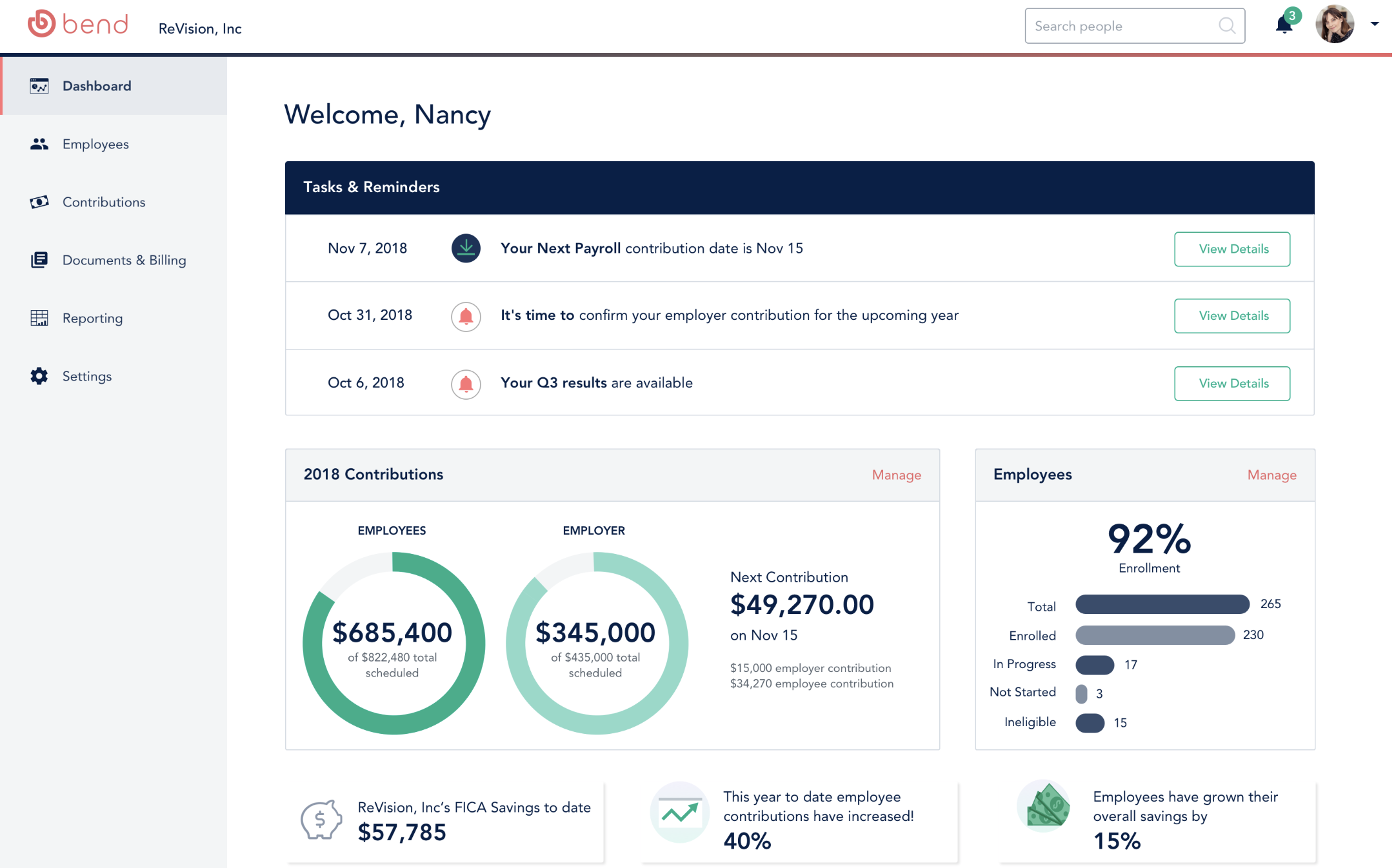

The Bend HSA offers artificial intelligence-powered, user-friendly software that not only helps employees set aside funds to avoid a healthcare-expense hardship, but also sets them on the right path toward employee financial wellness.

With 83 percent of employers currently offering financial wellness programs in the workplace—and another 14 percent considering similar education programs in the near future—employers are seeing the value these programs can provide their employees.

Download our eBook to learn more about employee financial wellness and how you can help employees get a path to financial health.

You May Also Like

These Stories on HSA

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think