Engaging non-funders in their HSAs with Artificial Intelligence

Health Savings Accounts (HSAs) are valuable financial tools for employees under high deductible health plans, and they provide numerous tax benefits. Yet many employees don’t understand the value of HSAs, so they aren’t taking advantage of them.

In fact, a recent Willis Towers Watson survey found that not only are most employees not optimizing their health account contributions or savings accumulations, nearly one in four said they don’t have enough money to contribute to their HSA. As a result, these “non-funders” often never bother to open an account or, if they do, they never fund or use it.

Increasing employee engagement in their HSA account helps drive tax savings for employers and overall satisfaction in HDHPs, as well as promotes cost-conscious behaviors. Employers, however, often lack the necessary tools to engage non-funders.

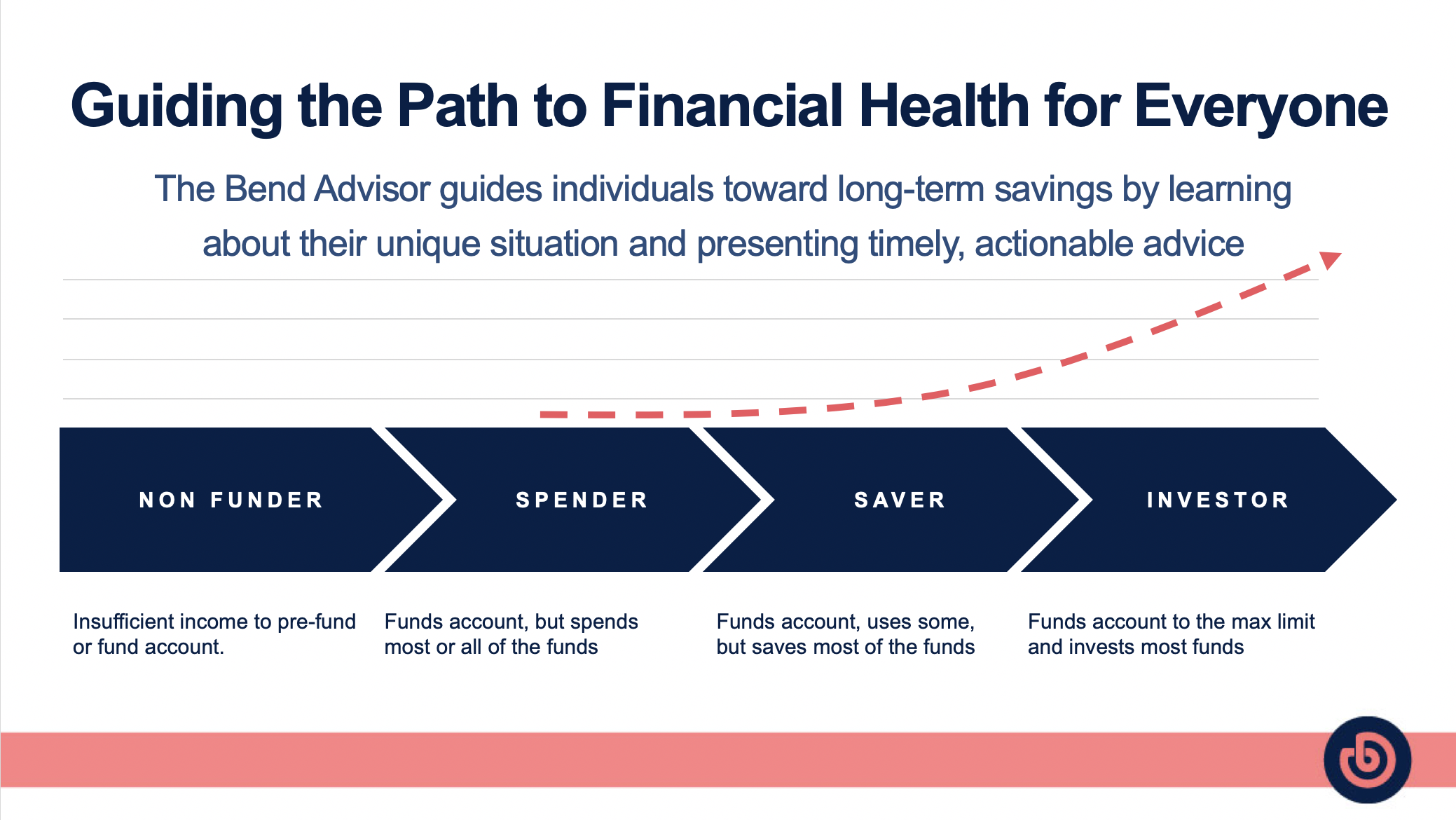

The Bend Advisor—Bend’s artificial intelligence-enabled platform—is a revolutionary breakthrough that nudges non-funders towards greater HSA engagement and guides them on the path to better financial health.

No need to prefund the account

Unlike other HSAs, the Bend platform is uniquely capable of helping consumers move from non-funders to spenders, to savers, then investors. Bend does this by identifying HSA-eligible expenses and making it easy for account holders to increase or initiate pre-tax payroll contributions throughout the year. This feature promotes employee satisfaction while reducing employer payroll taxes.

Linking personal cards to identify eligible expenses

Once enrolled, Bend prompts employees to link personal bank accounts and credit or debit cards to automatically identify eligible expenses to simplify deduction and reimbursement opportunities. As a result, it’s easy to contribute funds to the HSA and take full advantage of the tax benefits. As Bend learns more about each account holder, the technology better identifies those opportunities and even helps to set benchmarks that align with personal preferences.

Engagement ensures the success of your HSA

Traditionally, employers have struggled in engaging employees in the benefits of their health accounts. The Bend Advisor removes that burden from the employer, simplifying engagement and helping employees make smarter spending and saving decisions. By reducing the population of non-funders and increasing employee contributions, employers reap financial benefits through lower payroll taxes and greater FICA tax savings.

AI tools like the Bend Advisor prioritize employees’ needs at every step of the way, increasing financial health literacy and supporting cost-conscious behaviors while increasing HSA account balances (either cash or investments) and contributions that benefit everyone.

Would you like to learn more about our innovative HSA, or request a demo? Click here to send your request in.

You May Also Like

These Stories on artificial intelligence

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think