When it comes to having a health savings account, the importance of HSA contribution planning can’t be understated. Because while taking the step to open an HSA is a great start, investing the time and effort to figure out your most effective HSA contribution strategy can pay off big short and long-term. And when you partner with the right HSA provider, planning your HSA contributions doesn’t have to be stressful or time consuming, regardless of your HSA knowledge.

Eliminate the Guesswork with Bend’s HSA Contribution Planner

With a Bend HSA, you don’t have to be a health savings account expert to nail down a solid HSA contribution strategy. In fact, all you have to do is spend a few minutes with our new HSA Contribution Planner—to figure out the best contribution strategy tailored to you and your unique situation.

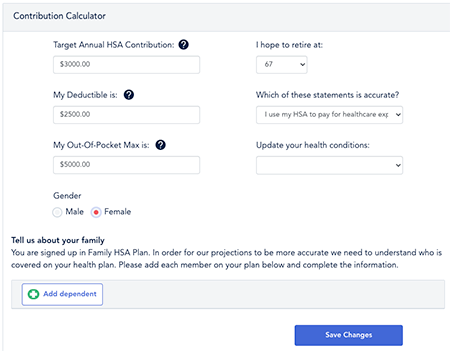

Available to all Bend HSA accountholders, our Contribution Planner lives right on your main account dashboard. The quick and easy-to-use tool has been thoughtfully designed to guide you toward the best HSA contribution planning strategy for your specific situation and circumstances. In a matter of minutes, our intuitive tool helps you calculate your overall annual contribution to plan for today and save for tomorrow.

How Bend’s HSA Contribution Planner Works—As Easy as 1-2-3

At Bend, we know sometimes “online calculators” don’t deliver what you need and end up being a waste of time. Whether it’s too many fill-in fields, or vague, unhelpful outcomes, there are many ways online calculators can fall short.

But not our Contribution Planner. While it’s set up as a simple HSA contribution calculator for ease of use—make no mistake—there’s a lot going on in the background to come up with your calculations to provide you real results.

For example, to estimate average medical costs, we simulate how much people with similar healthcare needs would spend on medical bills in your current health plan and then calculate the average amount spent, both for the current year and to your retirement age, based on the likely healthcare spending of people like you, both now and in the future, as you age.

This advanced simulation process allows us to then estimate your out-of-pocket costs—the amount of your medical bills that you’re responsible for —over time. We combine this with your HSA contribution amounts and HSA savings strategy to calculate whether you’re likely to have excess HSA funds at the end of each year and how much you’ll have left over on average.

And that’s just a small part of what’s going on in the background.

But however sophisticated on the backend, our Contribution Planner is as easy as one, two, three on your end.

- Simply enter some basic information specific to your situation, like your annual deductible, out-of-pocket maximum and target retirement age. Not sure what to fill in? No worries—Bend is right there with answers to your questions and recommendations to get you started.

- From there, Bend estimates your ability to pay for healthcare costs from your HSA for the current year, while also projecting your HSA balance at retirement.

- You can then go back and edit the information you initially filled in to see how changes could impact your long-term HSA outcome. You can do this as many times as you like to hone in on what works best for you. And the tool is always there for you to use and refer back to when needed.

Plan for Today. Save for Tomorrow.

Whether or not you partner with Bend and can utilize our new HSA contribution planning tool, there’s a simple mantra you should take to heart when it comes to your HSA contribution planning: “Plan for today. Save for tomorrow.”

It’s easy to look at your HSA as a basic transactional account only for paying for immediate healthcare expenses. Oftentimes that means making minimal contributions—or even no contributions at all. But using your HSA as a savings account that you spend down each year on medical expenses can end up being a shortsighted approach in more ways than one. You don’t maximize your tax advantages and you don’t leverage an HSA’s unique ability to build long-term, tax-free wealth.

So instead, consider shifting your perspective and viewing your HSA as the flexible, tax-advantaged tool that it is—one that can not only help you fund your current and future medical expenses, but also serve as a long-term investment vehicle to build you real wealth.

Maximize Your Triple Tax Advantage

When it comes to HSA contribution planning, from a tax perspective, it’s all about maximizing the “triple tax savings” an HSA offers. Because with a health savings account, your HSA contributions are 100% tax deductible, your HSA funds can be used tax-free for any qualified medical expenses and those funds grow tax-free from day one.

From a contribution planning standpoint, thoughtfully planning your contributions while saving and investing for future expenses can set yourself up for a bright and secure financial future. Simply put, if possible, it’s best to contribute the maximum annual limit to your HSA so you get the most significant tax savings upfront, while also having the most money added to your HSA to save and invest for the long term.

For 2020, that means you can contribute up to $3,550 if you have individual coverage, or up to $7,100 if you have family coverage. Not to mention the $1,000 catch-up contribution you can add into the mix for either coverage option if you’re 55 or older. Just remember, those annual maximum contribution limits include all contribution sources. So if you have an employer or anyone else who contributes to your HSA, you’ll need to adjust your own contributions accordingly so you don’t exceed the annual contribution limit.

The Best Way to Build Tax-Free Wealth

An HSA is truly a great option for your healthcare saving and spending. But it’s so much more than that. And how you take advantage of your HSA really comes down to how you approach your HSA contribution planning.

So keep this in mind—as tempting as it can be to make no or very minimal contributions to your HSA, you’re really shortchanging yourself today and into the future. Because not only are HSAs the best way to fund your current healthcare expenses while building equity for future healthcare expenses—quite frankly, they’re the only way to do so in such a tax-advantaged manner. Health savings accounts offer unrivaled tax benefits, better than 401(k)s and other retirement accounts. So it definitely pays to take the time to think over your contribution planning and adjust your approach if needed.

You’ll be happy you did.

Take Advantage of All Bend Offers

With Bend HSA, you get access to a next generation HSA platform filled with helpful HSA resources and tools like our Contribution Planner and so much more. We’re here to help you make the most of your health savings account—no matter who you are, where you’re at in life and what your HSA knowledge is. We offer a simple-to-use, secure HSA with a superior user experience and unmatched customer service and support—because we’re here to make HSAs easy for everyone.

You May Also Like

These Stories on HSA Education

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think