3 Key Principles to Make Your Employer-Sponsored HSA Program a Success

If you’re an employer who offers your employees a health savings account (HSA) eligible high-deductible health plan (HDHP), you’re missing out if you’re not also offering an employer-sponsored HSA program. You could also be missing out if you’re offering the wrong HSA program to your employees, or if you’re not even offering them an HSA-eligible HDHP to begin with.

Any of these scenarios could end up costing you a substantial amount of money—not to mention lost time, headaches, employee recruitment and retention issues.

Now more than ever, you need to make sure you make every dollar work the smartest it can for your business, and that’s where the right employer HSA program comes in. Offering your employees the best employer-sponsored HSA program can be a valuable win-win in more ways than just the money your business and your employees will save.

Not Offering an Employer-Sponsored HSA Program, or Offering the Wrong HSA Program, Can Cost You Money and More

So your business doesn’t offer your employees an employer HSA program—no big deal, right?

Wrong.

Not offering your employees an employer HSA program can negatively impact your finances along with your ability to recruit and retain top talent.

Let’s face it, we’re living in unprecedented times. Employees of all kinds are looking to find ways to cut costs, save money and make smarter financial decisions. Choosing an HDHP with an HSA for their health insurance provides them with an effective way to do just that and has become an increasingly popular choice over the past few years alone.

Think HSAs are just a flash in the pan? Think again.

- HSA-eligible health plan enrollment has grown, and will continue to grow, by more than 25% annually

- HSA accounts are on pace to exceed 30 million by 2022

Clearly, HSAs aren’t going away, and employees have come to expect an HDHP/HSA option when it comes to their health insurance choices. Not offering that option can present many challenges when it comes to your recruitment and retention efforts—now and in the years ahead.

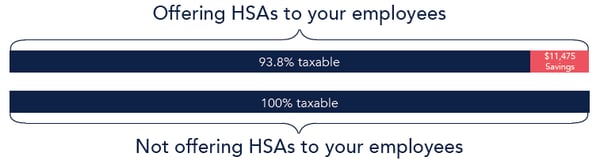

And on the financial side, not offering an employer HSA program means you’re not taking advantage of the critical FICA tax savings an employer-sponsored HSA program provides businesses of all sizes and scopes.

Here’s the gist on how it works—providing your employees with an easy way to make pretax HSA contributions through an employer HSA program reduces the amount of income that applies to FICA taxes, meaning it’s less you have to pay.

Let’s check out a quick example.

- Say you have 50 employees who each contribute $3,000 a year to their HSA. Through those contributions alone and using the FICA tax rate of 7.65%, your business can save $11,475 in FICA taxes. Most often, your FICA savings alone more than covers any cost of offering an employer-sponsored HSA program.

It’s important to note, your potential for FICA tax savings is only as good as the employer HSA program you offer your employees. Even if you are currently offering an HSA program to your employees, a subpar HSA program will net you subpar results and minimal FICA savings, not to mention headaches and less use by your employees.

So, how do you find the best employer HSA provider for your business? Use three key principles to guide your way.

Focus on 3 Key Principles for the Best HSA Provider and the Best Employer HSA Program

You have many choices when it comes to who you partner with for your employer HSA program. But it’s important to understand upfront—not all HSA providers are created equal. Make sure you take the time to explore how your prospective HSA partner leverages these three key principles to ensure HSA success for your business and your employees:

- Principle 1–Simplification

- Does the HSA provider make HSAs easy to use and understand for you and your employees, all while maximizing your respective tax benefits? Look specifically at HSA account management for you as an employer and for your employees. What administrative automations exist, and is the HSA platform designed to maximize results while eliminating headaches, regardless of someone’s knowledge of HSAs?

- Principle 2–Guidance

- Does the HSA provider recognize that your and your employees’ circumstances are all unique and that you need an employer HSA solution customized for your specific needs? In order to ensure HSA success for you and your employees, you need to find an HSA provider who provides personalized guidance every step of the way—both to you and to your employees. Any HSA provider that only offers a rigid, one-size-fits-all HSA program won’t produce the positive results you’re after.

- Principle 3–Consistency

- Has the HSA provider designed an employer HSA program that’s easy to manage and proactively engages your employees to deliver a consistent experience and optimal financial savings to both you and your employees? Does the HSA provider offer customized integrations with any health plan or benefit offering? And do they offer claims integration and other tools for easy documentation and consistent recordkeeping all in one streamlined location? When it comes to the success of an employer HSA program, consistency is key.

As an HSA industry leader, Bend has built a best-in-class employer HSA program around simplification, guidance and consistency. In fact, Bend is the only HSA provider that offers real-time, personalized guidance guaranteed to increase HSA engagement and produce real results.

Don’t Settle for an Average HSA Provider

Having options is a good thing. And not having to settle for anything less than the best HSA partner for your business is even better.

When you’re evaluating who to choose as the partner for your employer HSA program, just remember, use the three straightforward principles of simplification, guidance and consistency as your guide, and don’t settle.

Choose an HSA provider that can clearly demonstrate how they offer simplification, guidance and consistency to you and your employees. And make sure their platform is easy to use, with seamless enrollment and administration for you and your employees, along with dedicated, on-demand support whenever you need it. Be sure they provide comprehensive resources for you and your employees across different mediums—from videos, emails and handouts, to webinars, online tools and recurring newsletters. And make sure the HSA provider you choose leverages leading-edge technologies to provide you and your employees with proactive, personalized guidance and education throughout every step of the HSA process.

Because remember, at the end of the day, the more engaged your employees, and the more HSA funds they contribute, the more money you save in FICA taxes.

Let’s quickly revisit the original example we covered above regarding potential FICA tax savings:

- An employer has 50 employees who each contribute $3,000 a year to their HSA

- With an average HSA provider, the business saves $11,475 in FICA taxes

While those savings are nothing to scoff at, consider some of the highlights of working with an industry-leading HSA provider like Bend:

- Bend HSA average account balances are 47% higher than the industry average

- Bend HSA accountholders invest 33% more of their HSA funds than the industry average

- 25% of Bend HSA accountholders are saving at least 80% of their annual contributions, surpassing the industry average by nearly 10%

- Bend HSA accountholder year-to-date contributions are higher than the industry average

With this in mind, let’s run the numbers again if the employer partnered with Bend for their employer HSA program:

- The 50 employees each now contribute 20% more to their HSA, bringing the total amount to $3,600 a year per employee

- With Bend as the employer HSA provider, the business now saves $13,770 in FICA taxes

- That’s an additional savings of $2,295, just for choosing the right HSA provider

- With Bend as the employer HSA provider, the business now saves $13,770 in FICA taxes

Choose Bend and Make Your HSA Program a Win-Win

When you partner with the right HSA provider, your employer HSA program will be a win-win—providing your employees with a valuable benefit to save money in taxes, better control their short and long-term healthcare costs and invest in their future, while also providing your business with a critical recruitment and retention tool—not to mention the substantial FICA tax savings you’ll enjoy year over year.

And when you partner with an industry leader like Bend, you can take advantage of the most innovative employer HSA program on the market, without adding to your workload or causing headaches. Bend’s simple, online HSA program setup takes on average less than a half hour to complete. And once you’re up and running, you’ll enjoy our stable, secure, easy-to-navigate platform, complete with a dashboard providing instant access to:

- Tax savings to date

- Upcoming tasks

- Employer and employee contributions to date and planned

- And much more

You’ll also experience a host of time-saving administrative automations, including paperless employee enrollment and easy payroll integration.

Say yes to maximizing win-win benefits and implementing a leading-edge employer HSA program by partnering with Bend.

You May Also Like

These Stories on HSA

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think