How to empower employees to be smart consumers of healthcare

In health care, education is key.

Research has shown that with higher levels of patient education, patients are more involved in their care, which leads to more positive outcomes. The same can be said for health savings accounts (HSAs).

Since 2003, HSAs have been available to those with high-deductible health plans, providing immense tax benefits and reduced costs for employers and employees. Enrollment grew by 11 percent from 2017 to 2018 with approximately 22 million Americans utilizing HSAs.

Despite growing popularity, however, a lack of understanding about HSA is preventing additional eligible employees from enrolling. Of those who have not enrolled, 70 percent attributed it to not seeing the benefit of an HSA or understanding its purpose. Twenty-three percent of employees told the Insured Retirement Institute and the LIMRA Secure Retirement Institute they “lacked any knowledge” about HSAs.

Even those actively enrolled in HSAs conveyed confusion over the benefits of the account. Among those “somewhat knowledgeable” about HSAs, 41 percent incorrectly believed they must spend their HAS balance by year-end or risk losing the remaining funds.

For employers, this represents a great opportunity to further engage employees about enrolling and participating in an HSA. Research shows greater engagement can help employees make good “save versus spend” decisions through personalized online tools.

Employers need to implement a strategy which leverages educational and digital tools that work seamlessly to help employees realize the benefits of an HSA.

Clear communication

First and foremost, educating employees about HSAs can be tricky since even the most financially literate employees struggle to understand the value of and differences between health accounts.

Separating HSAs from flexible spending accounts (FSAs) and health reimbursement arrangements (HRAs) is important since HSA amounts are able to carry over after year-end. FSAs and HRAs either do not roll over or have different contribution/spending limits. Furthermore, an Employee Benefits Research Institute study showed that most employees used their HSA as “specialized checking accounts” for large expenses throughout the year — deductibles, copayments and coinsurance, rather than saving for the future.

In addition to the health savings benefits, HSAs are also triple-tax free (contributions, growth and withdrawal for qualified medical expenses) and are a valuable financial vehicle for future healthcare expenses and even retirement savings. HSA participants age 65 and older can also use funds for non-medical reasons without facing a penalty, though they would still owe income taxes.

Properly communicating how HSAs stand alone in their structure and benefits is key in ensuring employees are able to make the most of their participation.

Learn as you go

Think about learning a new computer program. You don’t read a manual, and from there, understanding everything about it and all of its nuances. You start small by learning the minimum, and continuing learning as you begin using it.

The same goes for understanding HSAs, especially eligible employees who may be using the health account for the first time. By limiting the upfront learning and simplifying the product understanding, employers are better able to reach those who would traditionally shy away from enrolling in an HSA.

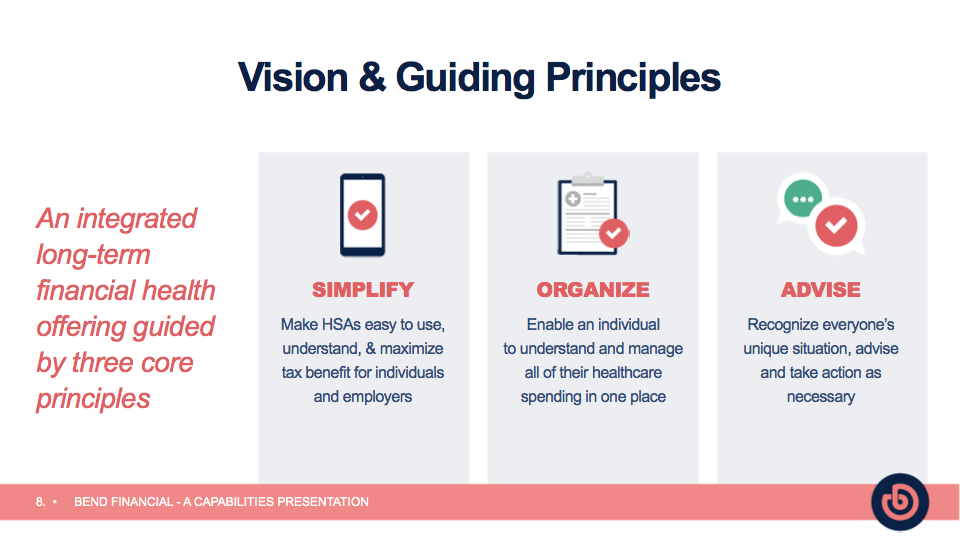

Bend’s platform, the Bend Advisor, is uniquely capable of employing a learn-as-you go approach to enrolling and participating in an HSA. From proactively identifying HSA-eligible expenses to prompting employees to link personal bank accounts and credit or debit cards, the Bend Advisor takes a step-by-step approach, intelligently providing timely suggestions so even the least knowledgeable HSA users are able to work toward optimizing their accounts.

Situation-specific

While the majority of eligible employees leverage their HSA account as a spending account for present-day health costs, each will also have their own unique financial and medical situations that arise.

Given this, situation-specific education is most effective in ensuring eligible employees receive the right advice at the right times. For example, Bend engages with brand new HSA participants by simplifying the enrollment process and proactively identifying the appropriate expenses eligible for HSA funds. Gaining this understanding is valuable for beginners, but would not have the same effect on those with much more HSA experience.

Bend’s artificial intelligence capabilities allow the platform to learn about the unique situation of each customer and provide actionable advice relevant to those situations. For HSA veterans, the advice may be more focused on how they can grow their pre-tax contributions and long-term savings, rather than identifying HSA-eligible expenses.

With the right education at the right time, employers can be confident that their employees are receiving consistent and timely education that will be most impactful for optimal HSA use.

Learn more about how a Bend HSA could help you and your company

Unlike other HSAs, the Bend platform is uniquely capable of helping consumers move from non-funders to spenders, to savers, then investors.

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think