Does Your HSA Provider Offer Comprehensive Employee Communications?

Offering your employees an employer-sponsored health savings account (HSA) program to work hand-in-hand with a high-deductible health plan (HDHP) option is a smart move in more ways than one. It helps your business and your employees save money and control healthcare costs and also provides your employees opportunities to boost both their short-term and long-term financial wellness.

If you’re not offering your employees an HDHP option with an employer-sponsored HSA program—or even if you’re offering an HDHP option but no employer HSA program—you’re selling your business short, missing out on substantial FICA tax savings and potentially causing serious recruitment and retention issues.

And even if you’re already offering your employees an HDHP option paired with an employer-sponsored HSA program, you still may not be seeing the buy-in you’re after, leading to less-than-optimal FICA tax savings, since the amount your business stands to save in taxes is directly related to the number of employees who open an HSA, along with how much they contribute.

When it comes to the success of any employer-sponsored HSA program, employee communication is essential.

Because even though HDHP/HSA combinations continue to surge in popularity, there’s still a large number of employees and healthcare consumers who don’t understand even the basics of how pairing an HDHP with an HSA can save them money and help them take a more active role in their healthcare, all while charting a path toward better overall financial wellness.

Does your HSA provider have you covered when it comes to employee communications? Do they provide all the tools and resources you need to make messaging your HSA program out to your workforce easy and effective? And do they offer communications for all times of year—not just open enrollment season?

If you answered no to any of these questions, you may want to rethink who you should partner with for your employer-sponsored HSA program.

Regardless of where you’re at with your HSA program and who your HSA provider is, there are steps you can take to make sure your employees are informed and have the tools they need to decide if choosing an HDHP with an HSA is the best option for them.

Emphasis on HSA Education that Actually Works

Your employees are busy people. And they’re often overloaded with responsibilities and decisions to make in their work life as well as their personal life. From the type of car insurance they select, to the type of health insurance they choose through their employer, oftentimes, the choices themselves aren’t given much thought—in today’s hectic world, it’s easiest to stick with the status quo until the next renewal or open enrollment period.

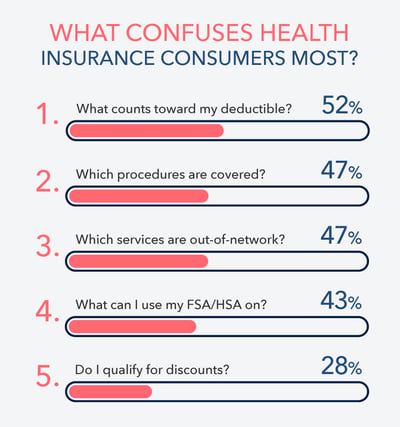

While everyone knows that’s not the best approach, it’s the reality of the situation. Change is hard, and even if resources are at their fingertips to become more informed and make better decisions, most times it’s just not enough of a priority. Couple that with the fact that communications and information surrounding HSAs can be complex and confusing, and it’s no wonder that while even though those with current healthcare coverage admit that they waste on average $111 monthly due to confusion surrounding their health insurance benefits, they still don’t feel confident enough to switch to an HDHP/HSA combination.

The continued confusion surrounding choosing the best health insurance coverage is real—especially with HDHPs and HSAs. And even though HDHP/HSA combinations continue to grow rapidly in popularity and demand, many employees are still lacking basic knowledge on what HDHPs and HSAs are. Case in point, a recent survey showed that 65% of people didn’t know that HSAs and FSAs are different things.

So, when it comes to educating employees on HSAs, it’s all about placing emphasis on methods that actually work and making it a priority for them.

Quick, clear, consumable communications, tools and resources are key to getting employees engaged and willing to read an email, watch a video, click a link and take action. And the messages themselves need to be value-driven. It’s all about why and how an HSA helps employees save money, control healthcare costs and gain opportunities to invest for better short-term and long-term financial wellness.

Educating to Drive HSA Engagement

While HSA education in and of itself is critical, HSA education that drives HSA engagement is absolutely essential to the success of any employer-sponsored HSA program.

Consider these tips on how to turn HSA education into HSA engagement:

- Think beyond open enrollment season–HSA education needs to be ongoing and provided throughout the year—not just during open enrollment. Give your employees the information they need and give them plenty of time to consume the information. ¬Bottom line—HSA education (and all benefits-related education) can’t be limited to only one time of year.

- Focus on basic HSA details and value-driven benefits–Remember, your employees are busy and may only have a moment to glance at the information you offer. So don’t dive deep into the weeds when providing HSA information. Stick to the basics and focus on the clear benefits HSAs offer.

- Leverage all the “whys”–To piggyback on the previous point surrounding basic, benefit-driven HSA details, be sure to let your employees know all the reasons why it makes sense to choose an HDHP and open an HSA. Go beyond just short-term savings and educate them on how long-term HSA investment strategies are surging with employees of all ages from all circumstances. Remember, based on the latest research, an average couple age 65 will need at least $300,000 just for healthcare expenses throughout retirement.

- Debunk misconceptions and clear up HSA confusion upfront–Get ahead of the curve and proactively address common HSA misconceptions and other points of confusion, like:

- An HSA and FSA aren’t the same

- The employee owns their HSA and all the funds in it—they never lose it, even if they change health plans, leave their job or retire

- HSA funds roll over year over year indefinitely with no penalty—there’s never a “use it or lose it” with an HSA

- HSAs provide not just one tax advantage, but rather three separate tax advantages

- Contributions made through an employer HSA program are pretax and lower taxable income

- Employees can use their HSA funds tax-free for any qualified expenses now or in the future

- All HSA interest and account growth through investments grows tax-free

- Show real-world examples with real numbers–Perhaps nothing is more effective than using real-world examples of what individuals and families alike can stand to save and gain by choosing HDHP coverage and utilizing an HSA. When it comes to HDHP coverage versus traditional options, premium comparisons are essential, along with showing how premiums are a fixed cost that’s washed away, whereas you can contribute the premium savings by choosing an HDHP to an HSA and even invest it for better long-term financial wellness. Even basic examples like this one can help bring things into quick focus:

- If you pay 25% taxes on your earnings, you’d have to earn $1,000 to pay for a $750 medical bill with traditional insurance. However, if you have HDHP coverage, use an HSA and make pretax contributions, you avoid taxes and only pay the true cost of $750. Even better, you can then put the $250 you saved into your HSA, along with the $150 you save monthly in premiums, and invest those funds tax-free through your HSA as an additional retirement savings vehicle.

- Lean into (or consider adding) employer HSA contributions to sweeten the deal–More often than not, employees are much more willing to switch to HDHP coverage and open an HSA when their employer makes contributions to their account. Offering employer HSA contributions can provide sizeable boosts in HSA program buy-in, along with overall recruitment and retention efforts and shouldn’t be overlooked in education and communication strategies.

The Importance of Communicating with Employees Through Multiple Channels

Along with providing HSA education throughout the year and following the other tips listed above, you also need to make sure that when it comes to HSA communications, you’re meeting your employees where they are and making it as convenient as possible for them to access the information in their preferred format. That means delivering communications across many different channels, including:

- Printed handouts, flyers and other collateral

- Digital materials

- Emails

- Videos

- Web resources, including interactive decision-making tools

- Webinars

- In-person information sessions

- FAQs

- Recurring newsletters

- And more

Now more than ever, your employees consume content in many different ways. You need to adjust and expand your communication approach accordingly.

Bend’s Comprehensive Employer Communication Kit Provides an Easy, Out-of-the-Box HSA Communication Solution

When you partner with a forward-thinking industry innovator like Bend, you get everything you need to easily and effectively communicate all things HSAs to your employees at every time of year. This includes:

- Pre-enrollment resources focused on what an HSA is and why your employees should care

- Specific open enrollment resources focused on why and how to enroll

- Ongoing educational and awareness resources focused on how to use and maximize an HSA

Bend’s Employer Communication Kit is truly comprehensive, providing tools and resources spanning from print and digital pieces, videos, web resources, webinars and customizable emails, to enrollment meeting support, monthly newsletters, FAQs, educational tools and resources and more.

And along with Bend’s Employer Communication Kit, Bend also offers the industry-exclusive Bend Advisor, intuitively designed to provide accountholders real-time, personalized guidance to stay supported through every step of the HSA journey and ensure they make the most of their HSA, regardless of their HSA knowledge base.

Bend provides a turnkey solution to a superior HSA program, including all the communication tools you need to make your employer HSA program a success.

Craft Effective Employee Communications and Maximize Your HSA Program with Bend

Beyond providing unmatched user experience and support and offering comprehensive employee communications, Bend takes the hassle and headaches out of HSA administration through thoughtful program design, easy-to-use features and industry-leading automations. And all that equals real results—because the right education and communication works.

Subscribe to HSA Blog

-

© Bend Financial Inc., 2019

- Privacy

No Comments Yet

Let us know what you think