The ins and outs

Using and managing your HSA

- Using your HSA for friends and family – The dos and don’ts

- Receiving reimbursement for HSA expenses you paid for yourself

- How to keep your HSA records in order

- Prescription-based vs. nonprescription drug HSA eligibility and details

- The letter of medical necessity – What it is, why you need it and how to get it

- What happens if you leave money in your health savings account?

- Checking your HSA balance

- Is it possible to overdraw a health savings account?

- HSA debit and credit cards – Using and choosing an HSA card

Using and managing your health savings account doesn’t have to be complicated, especially with a Bend HSA.. As long as you have a solid understanding of HSA basics, you can maximize your HSA while minimizing your time investment—and eliminating headaches. Remember, HSAs provide many advantages beyond their triple tax advantage. HSAs are also convenient to use and provide flexibility in more ways than one. Let’s dig into some of the most important topics you’ll need to know when it comes to most effectively using and managing your HSA.

Using your HSA for friends and family – The dos and don’ts

A common HSA question is whether or not you can use your HSA to pay for qualified medical expenses for your family and friends.

The short answer is yes for certain family members, and no for friends.

You can use your HSA for your spouse and your dependents, regardless of if they’re covered under your high-deductible health plan (HDHP) or not. Beyond that, using your HSA for others, including your friends, is typically a no-go. But let’s go beyond the short answer and look more at the dos and don’ts of using your HSA for family and friends.

On the family front:

- Do feel confident using your HSA funds for yourself, your spouse and any dependents you claim on your taxes—as well as anyone you could’ve claimed as a dependent but didn’t because of their filing status, total annual earnings or other tax-related reason

- Do make sure their expenses aren’t otherwise reimbursed in any other way

- Don't use your HSA funds for family members who aren’t your spouse or dependents—doing so will result in unqualified expenses and IRS penalties, including owing income tax on the unqualified expenses and a 20% penalty if you’re under 65

And when it comes to your friends:

- Don’t use your HSA to pay for a friend’s healthcare expenses unless you’ve listed that friend as a dependent under the IRS definition of a “qualified relative”

- Do consider alternative methods to help out your friends with their medical expenses, including:

- Giving your friend a gift outside your HSA–You can leave your HSA intact and gift your friend up to $15,000 annually from any other funds you have available without any tax implications or need to file any IRS paperwork

- Requesting HSA reimbursement for prior eligible expenses you paid for out-of-pocket–With an HSA, there’s no time limit for requesting reimbursement for qualified medical expenses as long as your HSA was open, meaning if there are eligible expenses you’ve yet to be reimbursed for, you can request reimbursement, and once you have the funds, they’re yours to do with what you wish, including using to help a friend

- Helping your friend find their own affordable healthcare coverage–Sometimes providing a friend with financial support is critical, but oftentimes, they might benefit even more from helpful guidance, like educating them on all the benefits of pairing an HDHP with an HSA and how that can help them achieve better financial well-being plus more control over their healthcare

And please remember, regardless of how you choose to use your HSA, all the HSA information provided here is for your reference only—Bend does not provide official tax or legal advice. Always consult with your qualified tax or legal adviser if you need additional help regarding your specific situation.

Receiving reimbursement for HSA expenses you paid for yourself

Another common HSA question is what rules exist around reimbursing yourself for qualified HSA expenses you paid for out-of-pocket.

When it comes to HSA reimbursement, you again stand to benefit from an HSA’s flexibility, because with an HSA, there’s no time limit for requesting reimbursement for qualified medical expenses. What that means is that as long as you incurred the qualified expenses when your HSA was open, there’s no deadline for you to request reimbursement. Say you paid for all your prescription drugs for the last two years with your credit card and not your HSA debit card. You can still reimburse yourself for all those expenses from your HSA funds. You just need to be sure you keep good records of all HSA-qualified expenses.

This is where things can get tricky. If you decide to defer HSA reimbursements and pay for eligible expenses out-of-pocket for months—or even years—you need to be sure that you remain diligent and keep comprehensive records and proof of all those expenses you plan to eventually reimburse yourself for. That means receipts, invoices and anything else that provides concrete proof of the details of each expense—what it was for, when it occurred and for how much. IRS audits on HSA reimbursements, especially when it comes to multiple years of reimbursement, aren’t uncommon. And if you can’t provide detailed records, you’ll be faced with paying income tax on all the expenses plus a 20% IRS penalty.

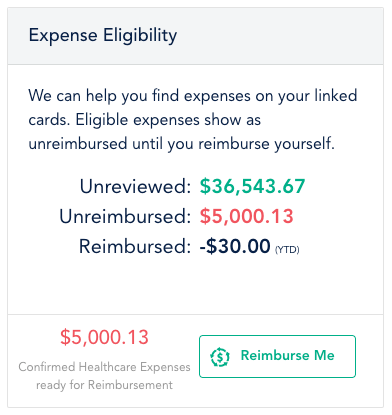

Luckily, with a Bend HSA, keeping track of your HSA-eligible expenses is easy. When you link your personal accounts with your Bend HSA, our cutting-edge platform finds and tracks all your HSA-eligible expenses, and our Bend Advisor then alerts you to these expenses so you can be sure you have receipts and any other documentation attached. From there, it’s your choice when you request reimbursement. And you’ll never have to worry about losing track with a helpful widget right at your fingertips showing all your reimbursed and unreimbursed expenses at a glance.

So, to sum it up, with an HSA, you don’t have a deadline when it comes to receiving reimbursement. You just need to keep your HSA records in order. Which leads us right into our next topic.

How to keep your HSA records in order

Health savings accounts come with a great deal of flexibility and freedom. But with flexibility and freedom comes responsibility. And when it comes to HSAs, it’s ultimately up to you to make sure you keep track of your HSA spending, ensuring that all expenses are HSA-qualified expenses and that you have appropriate records. If you don’t, you may end up paying income tax plus a 20% IRS penalty on any expenses deemed ineligible—whether because you broke the rules or just didn’t have the right records.

So, the first step of keeping your HSA records in order comes before you even make any payments out of your HSA. Before anything, you need to understand exactly what “qualified medical expenses” are as they pertain to HSAs—especially after the CARES Act coronavirus relief bill became law on March 27, 2020. Remember, you can use your HSA funds for a wide variety of eligible expenses—from office visits and surgical charges, to prescription drugs, vision and dental care and more. And through the CARES Act, you can now also use your HSA funds for telehealth and virtual healthcare services, over-the-counter medical products and more.

But there are a number ineligible HSA expenses as well, like aromatherapy, athletic mouth guards, baby bottles, cosmetic surgery purely for cosmetic reasons and more. You can find the complete, current list of qualified medical expenses for HSAs in IRS Publication 502. Just be aware, this IRS publications hasn’t been updated to include the CARES Act changes. You can learn more about those important updates on our blog.

Once you’ve educated yourself on what you can and can’t use your HSA funds for, the next step of HSA recordkeeping is just that—maintaining record of all your HSA receipts, invoices, statements and other important documents related to your account. Make sure you keep record of every single charge and HSA transaction. And when it comes to a time period for recordkeeping, best practice is to keep your HSA records for as long as your HSA account is open. Also remember, your annual tax return technically remains open in the eyes of the IRS for around three years after it’s filed—so long story short, even if you close or stop using your HSA, don’t be too quick to toss out all your HSA receipts and records.

When it comes to how you keep your HSA records, the choice is yours. With an HSA platform like Bend HSA, all HSA activity is tracked for you and available on-demand in a convenient “electronic shoebox.” If your HSA provider doesn’t offer automated account and expense tracking, you can choose to organize your records in whichever manner works best for your specific circumstance. Popular methods include creating spreadsheets to track your expenses as well as establishing both physical and digital folder structures to keep easy record and reference of your HSA expenses. You can choose to break your recordkeeping up by month, year or whatever interval makes sense for your healthcare spending.

At the end of the day, while it might take a bit of time to get things set up initially, HSA recordkeeping is straightforward and can be a simple process. You just want to be sure that if and when the time comes, you’ll have the proof you need to avoid any issues with the IRS regarding your HSA use.

Prescription-based vs. nonprescription drug HSA eligibility and details

As we’ve covered previously, it’s essential that you understand what HSA qualified medical expenses are—and that includes how prescription versus nonprescription medications and drugs are handled.

Prior to COVID-19, the IRS stated that, “…only prescribed medicines or drugs (including over-the-counter medicines and drugs that are prescribed) and insulin (even if purchased without a prescription) will be considered qualifying medical expenses and subject to preferred tax treatment.”

But after the CARES Act was signed into law on March 27, 2020, nonprescription drugs and other over-the-counter medical products became eligible for HSA reimbursement. Even feminine hygiene products made the list of HSA-qualified OTC medical product expenses.

What that boils down to is this—now, prescription drugs and medications—along with nonprescription drugs and other over-the-counter medical products—are all eligible to be reimbursed through your HSA. You no longer need a prescription for nonprescription drugs and medications to be eligible.

This expansion of HSA eligibility provides HSA accountholders with a potentially sizeable savings boost, and is critical to understand to make the most of your HSA spending.

When in doubt—or without a prescription—check IRS Publication 502 before spending with your HSA. Just remember, that publication doesn’t include updates due to the CARES Act.

The letter of medical necessity–What it is, why you need it and how to get it

If you have an HSA, you need to know what the term “letter of medical necessity” means. Chances are, at some point in time on your HSA journey, you’ll need to ask a provider for a letter of medical necessity for your HSA.

So what is a letter of medical necessity? A letter of medical necessity is essentially a doctor’s statement, written by your doctor or licensed healthcare provider to verify that the medical services, procedures, products, drugs or otherwise you’re receiving are necessary for some element of your healthcare, whether for diagnosis, prevention or treatment of a medical condition or issue.

Why do you need a letter of medical necessity for your HSA? Simply put, the IRS requires a letter of medical necessity to substantiate certain HSA-eligible expenses that could otherwise be misused. The letter of medical necessity eliminates any questions from the IRS perspective on the nature of the expense. Typically, a letter of medical necessity will need to be provided during an IRS audit, though it’s recommended you take a proactive stance and secure a letter of medical necessity anytime you’re seeking medical services that could come into question. Common HSA-qualified expenses that sometimes require a letter of medical necessity include:

- Acupressure

- Acupuncture

- Allergy products and treatments

- Alternative treatments, like chiropractic care and naturopathy

- Massage therapy

- Vitamins and supplements

So, now that you know what a letter of medical necessity is and why you need one, how do you actually get a letter of medical necessity? The answer is simple—just ask your healthcare provider for one. Luckily, most healthcare providers are in-tune with and up-to-date on what medical services and products require a letter of medical necessity, meaning oftentimes, you don’t even have to ask. And another plus, many HSA providers offer templated versions of a letter of medical necessity. These can be given to your healthcare provider to help expedite the process and to ensure that all appropriate details are given the first time around.

So when it comes to any HSA-eligible expenses, be informed. And if there’s a question, get a letter of medical necessity. It’s quick, simple and will help ensure you don’t run into any issues with the IRS.

What happens if you leave money in your health savings account?

Health savings accounts provide many benefits. From multiple tax advantages and investment opportunities, to flexibility and convenience, HSAs give you the ability to take an active role in your healthcare while controlling your healthcare costs. Two of the most important HSA advantages pertaining to flexibility and your HSA funds are an HSA’s portability and infinite rollover capabilities.

From an HSA portability standpoint, what that means is your HSA remains with you no matter what, regardless of job changes, health insurance plan changes or even retirement. Bottom line—your account itself and the money you leave in your HSA is yours to keep and use.

And from a rollover standpoint, when you leave money in your HSA, you won’t be faced with a “use it or lose it” scenario like you are with many other tax-advantaged accounts like FSAs. Any funds left in your HSA at the end of the year, or due to a change in employment, healthcare coverage or other circumstance, roll over indefinitely with no penalties or charges. The contributions in your HSA—including any employer contributions if applicable—will always remain available to use for qualified medical expenses in the same tax-advantaged way as the day you set your HSA up. And when you retire, you can even use the funds for non-medical expenses with no penalty.

An HSA’s portability and rollover capabilities mean it’s a good idea to view your health savings account not simply as a 12-month account, but rather a lifelong financial tool. With the right HSA provider and a savvy strategy, your HSA can help you with not only your present, but also your future—for medical expenses and much more.

It’s also important to note, the money you leave in your HSA can continue to grow tax-free, including any HSA investments like those available through a Bend HSA.

And when it comes to future planning, you can rest easy knowing that you can designate beneficiaries who will be able to take advantage of any remaining HSA funds when you’re gone.

Checking your HSA balance

When it comes to effectively managing your health savings account, knowing why, where and how to check your HSA balance is critical.

First, let’s start with the why. Why bother checking your HSA balance?

Keeping current on your HSA balance ensures you know exactly how much you have to use toward HSA-eligible expenses, as well as if you have to adjust your HSA contributions for any reason. Plus, keeping track of your HSA balance helps you make sure you’re getting the most out of your HSA. Because remember—your HSA contributions aren’t taxed, and you earn tax-free interest on your HSA balance.

Next, let’s answer where and how you check your HSA balance.

Where and how you check your HSA balance can differ slightly based on who your HSA provider is, so we’ll cover the common options provided by most HSA administrators for checking your HSA balance.

Two popular options are checking your HSA balance through your online account or a mobile app. Both of these options provide 24/7 access to your HSA balance, where you can see your HSA balance in real time, along with your transaction history and other important account details. With a health savings account like a Bend HSA, you can find your HSA balance, along with all your main account information, in one user-friendly dashboard on both Bend’s website and mobile app.

While not as tech-forward, you can also go “old school” and check your HSA balance by phone or through your monthly statement—if you choose to receive a paper statement. Many HSA providers offer an opt-in to paperless HSA statements. So be sure you set your preferences accordingly.

Ultimately, regardless of how you check your HSA balance, be sure you do—regularly. Staying on top of your HSA balance and other important account details will ensure you maximize your HSA goals.

Is it possible to overdraw a health savings account?

Can you overdraw your HSA? The short answer is yes. That’s why it’s so important that you check your HSA balance regularly and know the HSA funds you have available.

More often than not, your HSA provider will provide you with an HSA debit or credit card. Depending on how your card is set up, you may be provided with a failsafe that denies any charge attempted when nonsufficient HSA funds are available. But if that’s not that case, you could be subject to an overdrawn account and incur fees if your HSA doesn’t have sufficient funds to cover a transaction when it’s processed. Again, it’s critical that you actively maintain and monitor your HSA to avoid any adverse account action.

The IRS states that having a negative HSA balance is prohibited by federal law. And while the IRS doesn’t provide any specific guidance beyond that statement, you need to be sure that no expenses cause your HSA to fall into a negative balance.

Long story short—don’t overdraw your HSA.

HSA debit and credit cards – Using and choosing an HSA card

Most modern HSA providers, like Bend HSA, provide their accountholders with an HSA payment card that makes paying for HSA-eligible medical expenses quick and easy. Typically, your choice of HSA card is dependent on what your HSA provider offers. Most commonly, you’ll be provided with an HSA debit card.

Regardless of card type, using your HSA card eliminates the need to pay upfront out-of-pocket for eligible expenses, which also means you don’t have to deal with reimbursement from your HSA after the fact. You simply swipe your card, the payment is processed in real-time from your HSA and you move on with your day.

When you use your HSA debit card, you benefit from convenience and overall ease of use. Upon receiving your card, all you need to do is activate and sign it before your first use. Then, whenever you use your HSA debit card for an eligible HSA expense, all you have to do is use it as you would a regular credit card. While it is a debit card, you’ll likely need to choose “credit” when paying with your card, which eliminates the need for a PIN. You’ll simply sign for your purchase, the amount will be immediately deducted from your HSA and you’re on your way.

Using your HSA card is simple. But just remember, you can overdraw your HSA, so you need to be sure that you stay on top of your HSA balance. And also remember, you still need to be sure you keep good HSA records, just in case any of your expenses ever come into question.

With Bend HSA, you can also rest easy knowing that using your HSA card isn’t your only option for keeping things simple. By linking your personal spending accounts to your Bend HSA, the Bend Advisor immediately gets hard at work identifying and cataloging any and all HSA-eligible expenses you make—regardless of which payment method you use. This means no expenses are left behind, and you don’t have to waste time going back and manually reviewing your expenses. Everything is saved for you and able to be reimbursed quickly and easily whenever you choose. This can be an especially great option if you use your HSA as a long-term financial tool, where you prefer to pay for medical expenses out of pocket upfront, and then request reimbursement at a later date—even years later. Because remember, with an HSA, there’s no deadline on receiving reimbursement as long as the expense was made when your HSA was open.

Having an HSA card is helpful. And having the Bend Advisor is even better.

© Bend Financial Inc., 2024 | Privacy

Contact Us

Contact Us