Only $1.75 per Employee

Easy HSAs for Employers

With the Bend FDIC-insured HSA, you can offer employees a great HSA — without adding to your workload or burdening your team. The result? More motivated employees and greater savings for you and your teams.

Discount Pricing Ends In:

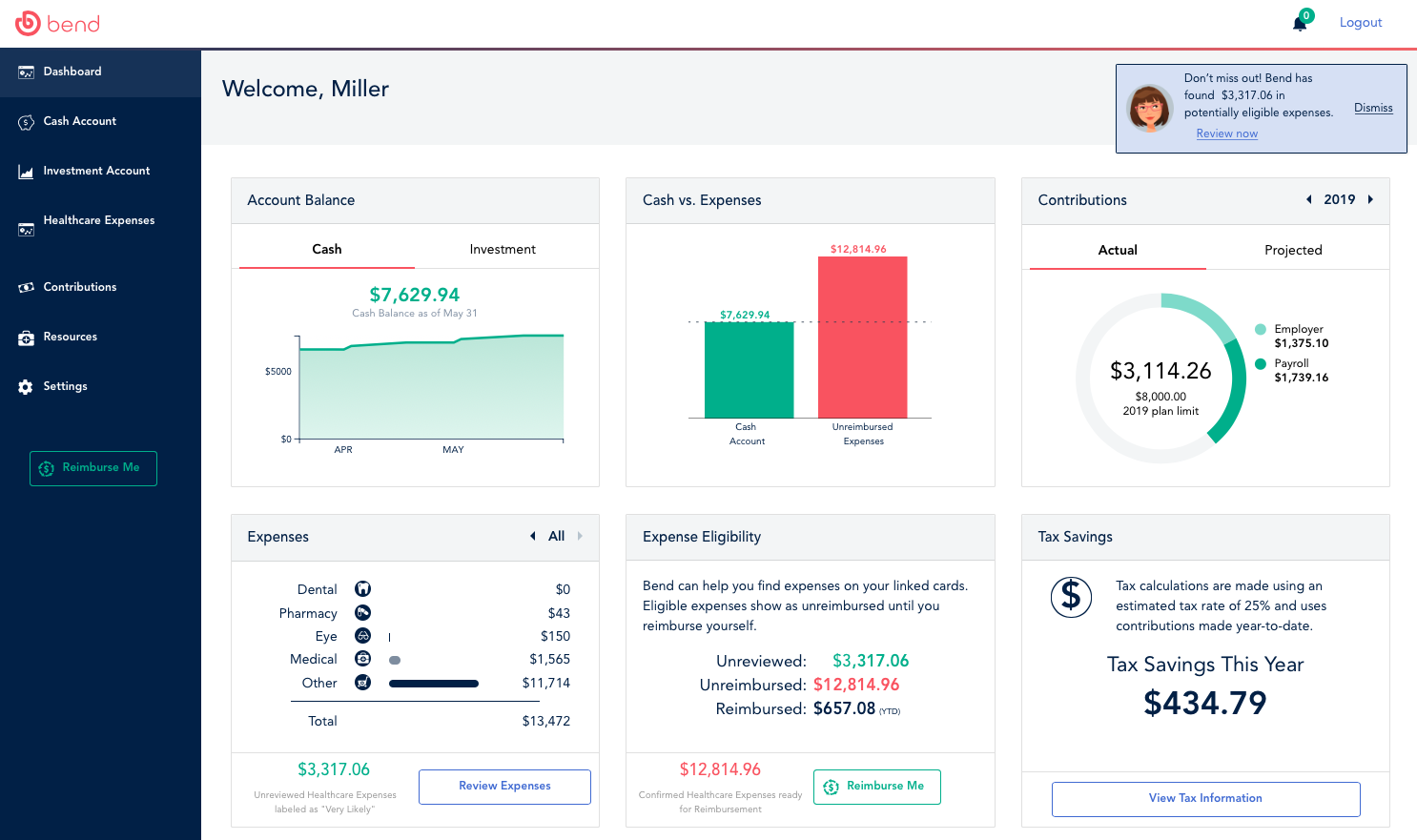

Our dashboard gives you a quick view into your program.

including features such as:

Simplifying your day

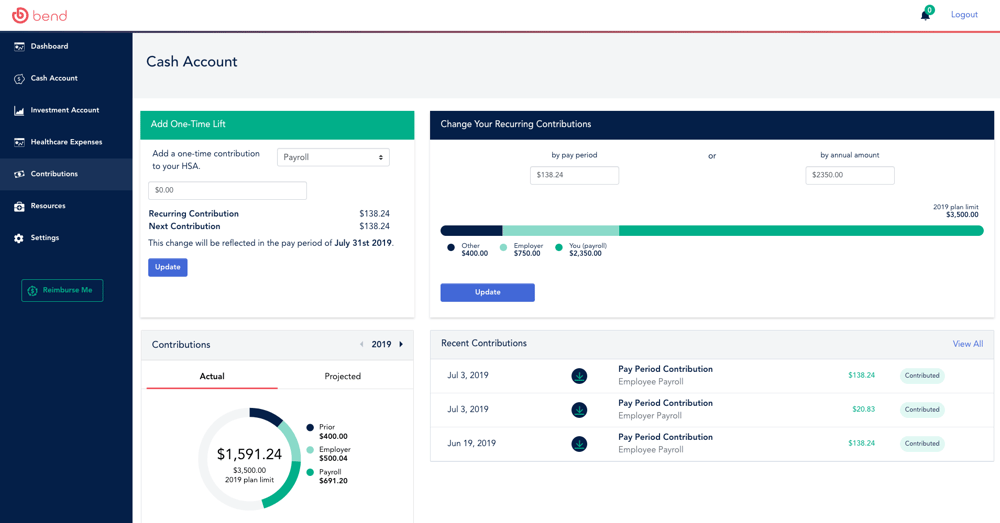

Bend helps reduce the headache of managing an HSA program through automation. And with our integration into payroll, even frequent payroll updates are automated so you don’t have any additional workload to manage. This simplification begins with the implementation, which is easy, automated and most often is completed in 1 hour or less.

Available on iOS and Android.

|

|

User ExperienceCreates outstanding, customized user experience based on individual activity. |

|

|

ReimbursementMakes reimbursement simple and easy for everyone. |

|

|

TransparencyDelivers a 360-degree view of expenses through links to personal spending accounts. Accountholders can view all their spending activity, while the Bend Advisor uses artificial intelligence to guide them regarding which expenses are HSA-eligible and actions to help them maximize the benefit of their HSA. |

|

|

EducationReduces planning and education needs. |

|

|

SimplifySimplifies HSA use and drives engagement. |

|

|

SavingsUses behavioral economics to nudge savings. |

Leading the way to financial health

And because Bend makes it easy for employees to identify eligible expenses and increase their pre-tax payroll contributions as they go, it leads to a growth in employee contributions. The more employees make an HSA contribution, the lower your payroll taxes and the greater your FICA tax savings.

You can lock in a low rate of just $1.75 per employee per month by signing up today.

The three characteristics of a powerful HSA offering provide employees with the financial savings security blanket and short-term tax savings while also helping make healthcare costs more affordable.

Leverages technology – Most HSAs are simply an online deposit account designed for debit transactions. However, and HSA with robust technological capabilities, such as artificial intelligence, is able to understand and anticipate an employee’s unique spending habits and situations and then make actionable recommendations to educate them on how to maximize their HSA funds. Artificial intelligence can satisfy the need for ongoing education for the majority of employees that don’t understand how to maximize their tax savings through the HSA.

Simplifies administration and HSA enrollment – Too often, employers don’t receive adequate support from HSA providers in administering the accounts to their employees. An HSA provider that automates payroll management and simplifies both the administration and implementation of the accounts, as well as the enrollment of employees, will make for a more satisfying experience and preparation for the inevitable increases in out-of-pocket healthcare costs as retirement approaches.

Doesn’t let accountholders get complacent – The reactive nature of HSAs only hurts employees in the long run by allowing them to get complacent in how they either contribute to their HSA or let it sit inactive. Proactive HSAs that actively engage account holders with timely nudges, such as reminders to contribute, as well as document eligible expenses for future reimbursement, will help ensure each account holder is on a journey to optimizing their contributions and maximizing their savings. Currently available technology not only enhances savings opportunities, but also maximizes the capturing of eligible expenses and will ensure the accountholder takes full advantage of the triple tax savings that only an HSA can provide! This same technology also automates payroll management and administration of HSA related tasks.

Even for active HSAs, there’s much room for growth. In 2017, one-third of active HSAs received no contributions and only 15 percent of employees maxed out their HSA contributions. With timely nudges or messages, employers can encourage consistent and optimal financial savings from their employees.

-

© Bend Financial Inc., 2019

- Privacy

leverages artificial intelligence to support and engage users at a deeper level.

leverages artificial intelligence to support and engage users at a deeper level.